Centauri designs quantitative research and execution frameworks dedicated to option markets. Proprietary tooling and large-scale datasets enable systematic analysis, backtesting and controlled execution across short-dated, liquid derivatives.

Engineering the edge

in global option markets.

We combine quantitative research, cutting-edge data and short-dated options

to build controlled, transparent and capital-efficient strategies.

overview

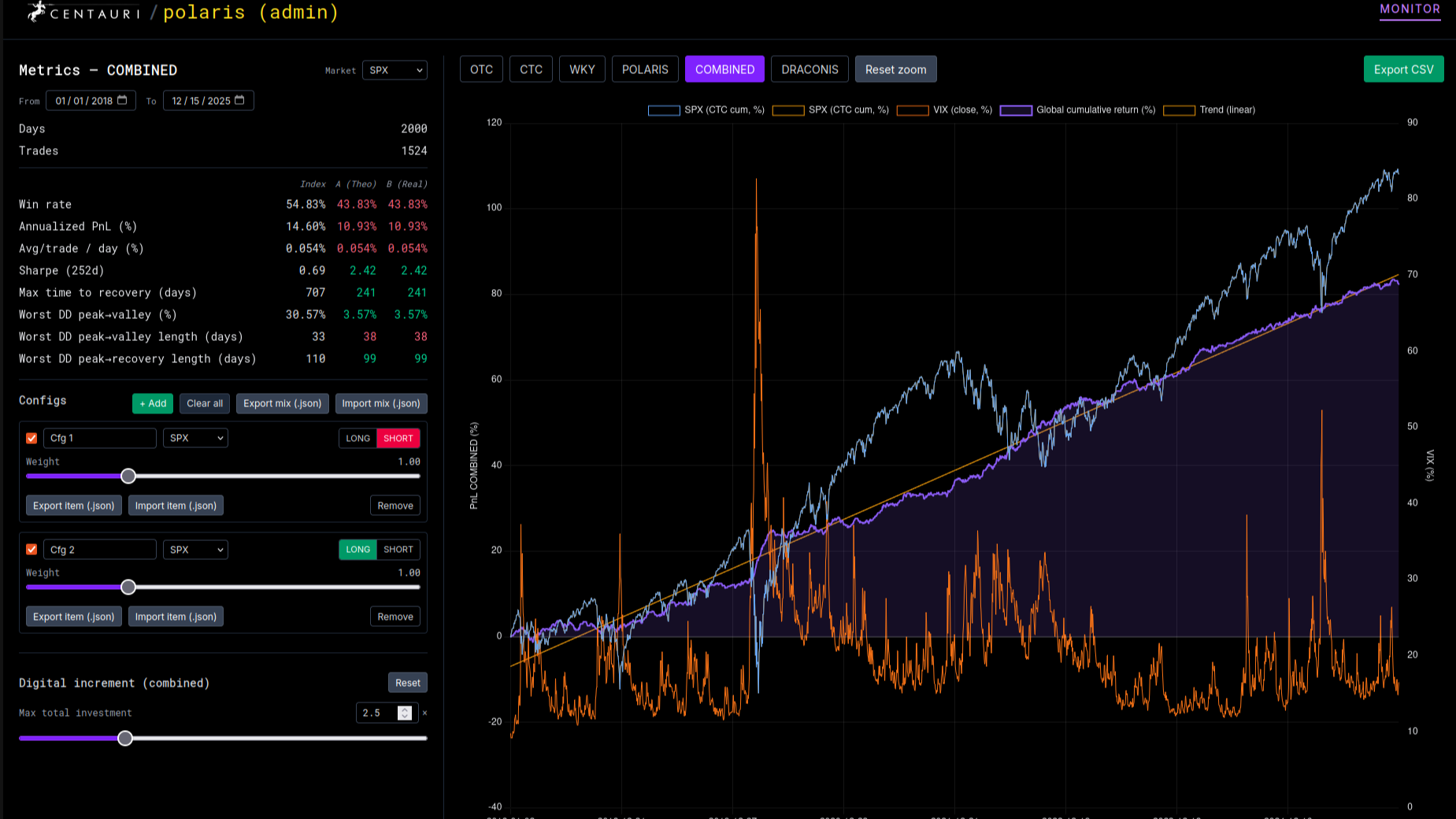

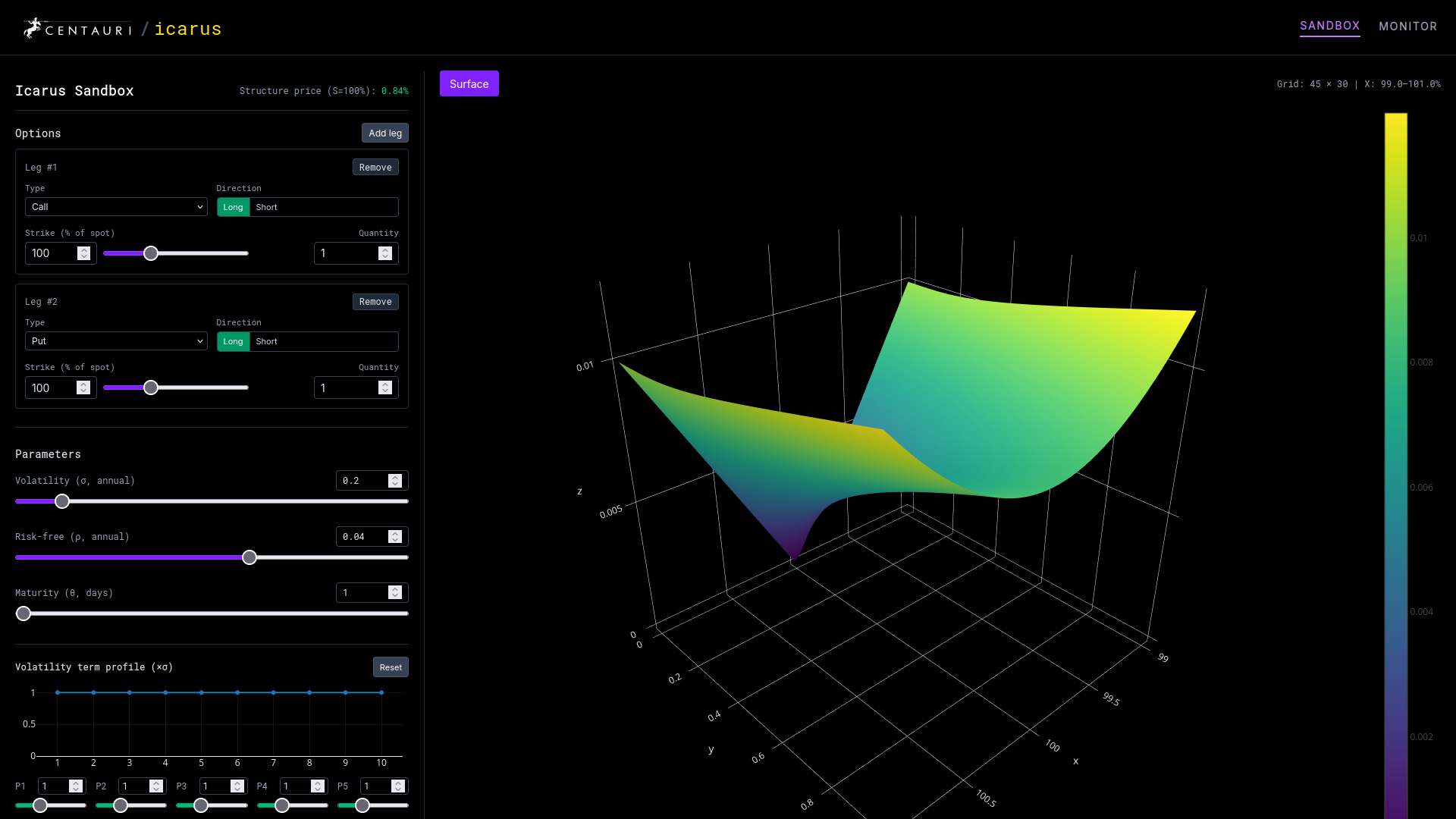

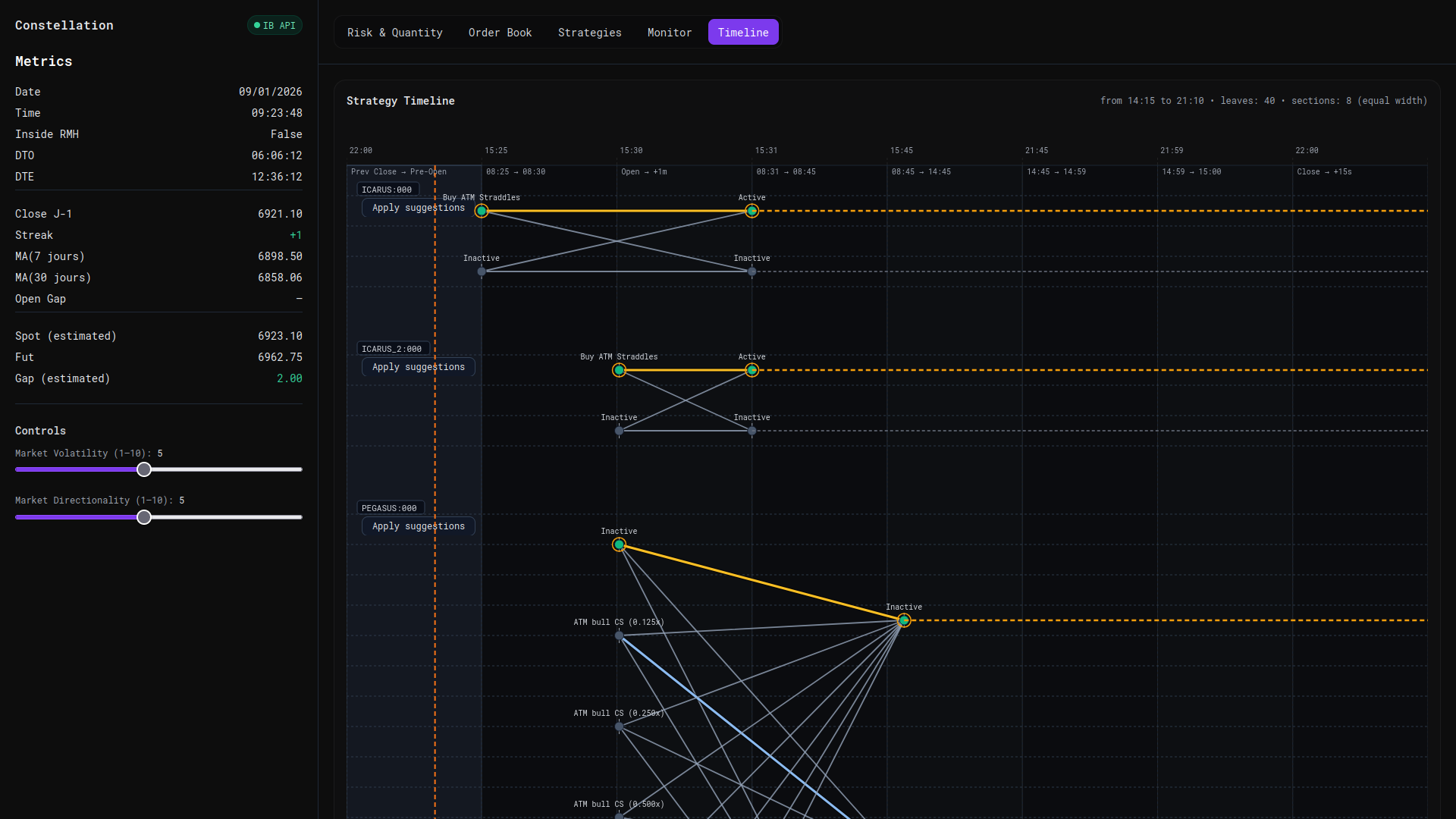

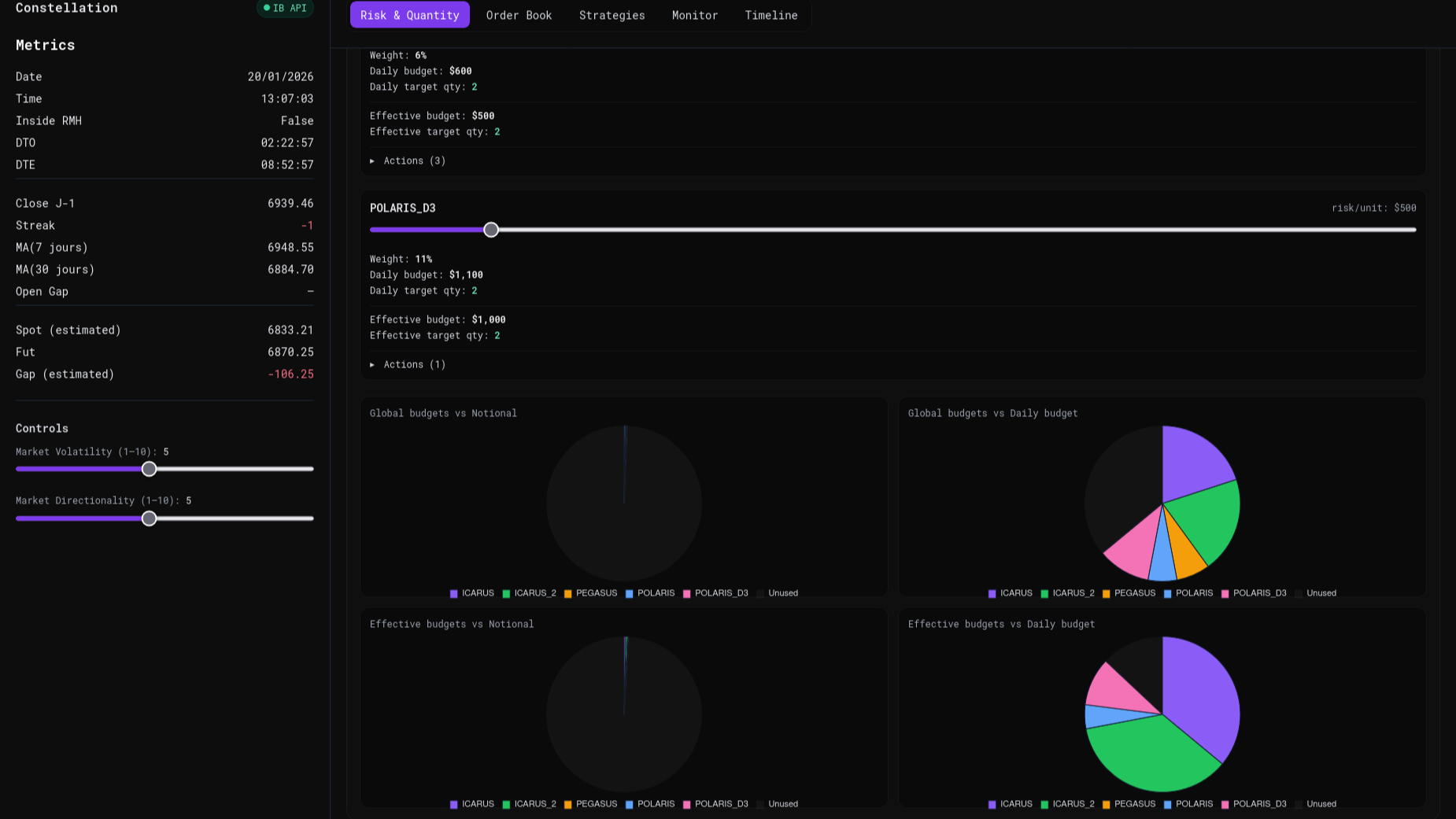

Quant research & order management tools

Advanced derivatives strategies analysis & audit (investment & hedge)

Centauri designs and develops quantitative strategies for investment and hedging purposes. Leveraging proprietary research tools and industrial-scale datasets, the firm is able to assess the statistical performance of advanced solutions by replaying options markets at microsecond resolution over multiple years.

Investment strategy modeling for investment & AM companies

Centauri conducts independent quantitative analysis and audits of option-based investment and hedging strategies. Its framework evaluates payoff structures, risk dynamics and robustness across multiple market regimes.

tools

team

The team of engineers gathers:

- Quant research & derivatives trading experience since 2004

- High skills and most recent knowledge in coding, AI, sysadmin and datamining

- Past positions in world class CIB

- Founding & executive management of European & US asset management firms (AUM raising from 0 to $1.5bn notional)

edge

Edge through research & technology

- Experience & agilitySeasoned quantitative research combined with fast execution cycles.

- State-of-the-art technologyMassive use of recent technologies : data, analytics & execution.

- Access to the most recent marketsNewest option contracts (including daily expirations). Continuous access to high-frequency and alternative datasets. Research on new underlyings, including digital assets.

- Advanced analyticsNew macro analysis & quant tools (such as AI)

Strategy design: secured by construction

- Market riskOptions spreads only, always long exposure.

- Operating riskCash-settled, non-assignable option contracts.

- Counterparty riskExchange-traded derivatives only.

- Liquidity riskShort-term maturities on the most liquid option contracts.

- Capital usageExtremely low use of cash, fully transparent structure.

key figures

2017

inception date

21

years experience

84

markets covered

faq

Centauri develops option-based frameworks grounded in quantitative research and systematic execution.

Strategies are designed using proprietary research tools, large-scale datasets and historical option market replays.

The focus is on statistical behaviors, structural properties of options, and repeatable patterns observable across market regimes.

Risk management is embedded by construction, not added afterward.

Centauri’s frameworks rely on:

- Always net option buyer positions

- Risk strictly limited to paid premiums

- Short dated, cash settled, European-style instruments

This structure ensures predefined downside, controlled cash usage, and clear exposure at all times.

Short-dated options offer:

- Higher liquidity & tighter bid-ask spreads

- Faster feedback between hypothesis and outcome

- No overnight position (for 0DTE options)

- Less time value

- Better operational risk control (spontaneous expiration)

- No mark-to-market

They allow precise modeling of risk, rapid iteration of research, and reduced exposure to long-term uncertainty.

Centauri operates both proprietary research and collaborative engagements.

Certain frameworks are:

- Adapted to specific mandates

- Integrated into existing investment processes

- Delivered as technology, analysis, or modeling tools

Sharing these frameworks allows Centauri to scale its research impact while working alongside investment and asset management firms under defined constraints.

Centauri typically works with investment firms, asset managers, hedge funds willing to develop an option-based business line.

The focus is on partners who value transparency, structural risk control, and systematic approaches over discretionary decision-making.

Engagements typically include:

- Quant research & order management tools

- Advanced derivatives strategy analysis and audit

- Investment strategy modeling for investment and asset management companies

Each collaboration is tailored to the client’s objectives, constraints, and operational environment.

market weather

Macro context filtering

Our analytical systems process publicly available macroeconomic information sourced from the web and specialized financial media. This information is combined with proprietary market data and pre-defined quantitative indicators in order to produce descriptive market context signals, based solely on available and observable data.

For Jan 21st 2026:

(These tools are intended to support analysis and decision-making processes and do not constitute, on their own, investment advice or discretionary portfolio management).